Minimum Wage: Federal vs. State

A Little History

* The concept of a minimum wage isn’t new and has been a tradition for over a century. New Zealand was the first nation to introduce a minimum wage in1894, followed closely by Australia in 1896. Throughout the 20th century, labor activism shows that countries with the highest minimum wages seem to be the happiest.

Dictionary Definitions

* Minimum Wage…A wage established by contract or by law as the lowest that may be paid to employees during a specified type of work.

* Living Wage…A wage sufficient for living in reasonable comfort.

* Reasonable…Using or showing reason or sound judgment.

Common Sense Definition

* No need for two full-time salaries to make ends meet, and have a stay-at-home parent to raise children.

The Federal Minimum Wage

* The Federal Minimum Wage, established by the Fair Labor Standards Act (FLSA) , sets a baseline for the minimum hourly wage that employers must pay their employees. As of now, the federal minimum wage stands at $7.25 per hour. This standard is intended to provide a uniform wage floor across the country to protect workers from exploitation and ensure a basic standard of living.

State-Specific Minimum Wage Laws

* While the federal minimum wage sets a nationwide standard, states have the authority to enact their own minimum wage laws. These state-specific laws can set a higher minimum wage than the federal standard, but they set a lower wage under certain circumstances. When sate and federal minimum laws differ, employers are generally required to pay the higher wage to ensure compliance with both sets of regulations.

Lower State Minimum Wages

* Some states have chosen to set their minimum wage lower than the federal standards for various reasons. These reasons can include:

Economic Conditions…States with lower costs of living and different economic conditions may argue that a lower minimum wage is more appropriate for their local economies.

Political and Legislative Factors…State legislatures and political climates can influence minimum wage laws. In some states, there may be less political will or legislative support to increase the minimum wage.

Business and Industry Considerations…Certain industries and businesses may lobby for lower wages, arguing that higher wages could lead to increased costs and potential job losses.

Introduction to Tip Credit

* In the realm of labor law, a Tip Credit allows employers to count a portion of the tips received by employees towards the employer’s obligation to pay the federal minimum wage.

Tip Credit = Tips Collected ($) divided by Time Worked (hours) = $ per hour

now

Total Compensation = State Minimum wage + Tip Credit

* When Total Compensation is equal to, or greater than, the federal minimum wage the employer has met the obligation to pay the federal minimum wage; and the employee keeps all of the tips collected.

* When Total Compensation is less than the federal minimum wage, the employer must pay the employee the difference between Total Compensation and the federal minimum wage; and the employee keeps all of the tips collected.

Controversies and Legal Challenges

* Tip Credit has been subject to numerous controversies and legal challenges. Critics argue that it can lead to wage theft (ref. Post #148) and exploitation, particularly if employers fail to comply with legal requirements.

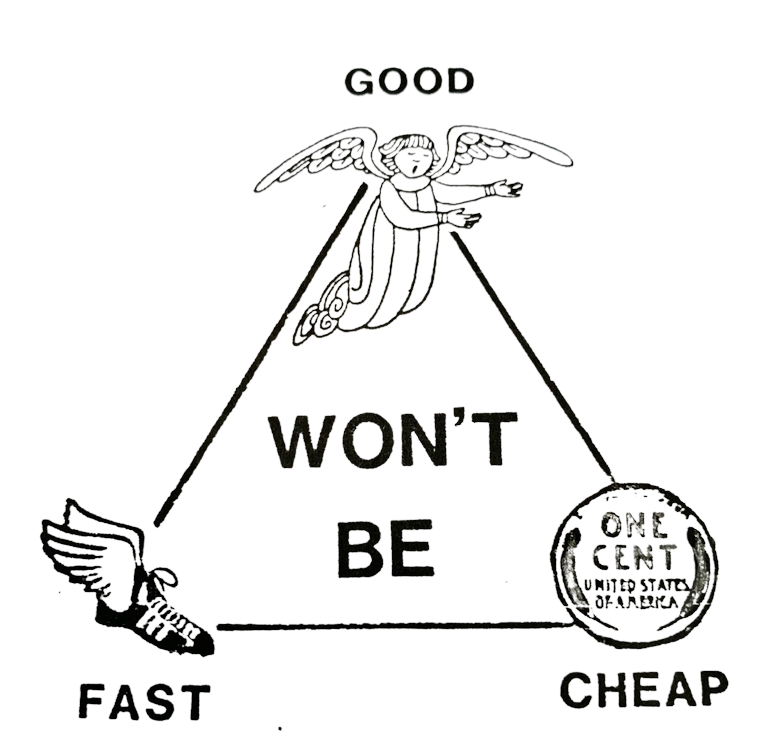

NO COMMON SENSE

ANALYZE THE EXAMPLE

* Which supports and barriers were in play?

* What were the dynamics?

* Who, or what, won the Tug-of-War?

* Discuss the outcome with your friends and family.

* Use Post #4 as a reference for the relationships and dynamics between supports and barriers.

PS…Here is a list of the 2025 minimum wage in each of the United States.

$ per hour…State

15.74…Washington

15.50…California

15.00…New York

15.00…Massachusetts

15.00…Connecticut

14.50…New Jersey

14.20…Oregon

14.00…Colorado

14.00…Maryland

13.85…Arizona

13.50…Minnesota

13.18…Vermont

13.00…Maine

13.00…Rhode Island

13.00…Florida

13.00…Virginia

13.00…Maine

12.50…Michigan

12.00…Hawaii

12.00…New Mexico

12.00…Nevada

12.00…Missouri

11.75…Delaware

11.00…Arkansas

11.00…Illinois

10.80…South Dakota

10.50…Nebraska

10.34…Alaska

10.10…Ohio

9.95…Montana

8.75…West Virginia

7.25…Pennsylvania…Wisconsin…Indiana…Kansas…New Hampshire…North Carolina…North Dakota…Oklahoma…South Carolina… Tennessee…Utah…Texas…Wyoming…Alabama…Georgia…Idaho…Iowa…Kentucky…Louisiana…Mississippi.

FYI: (40) hrs/wk x (52) wks/yr = 2,080 hrs/yr

7.25 $/hr x 2,080 hrs/yr = $15,080 /yr

15 $/hr x 2,080 hrs/yr = $31,200 /yr

20 $/hr x 2,080 hrs/yr = $41,600 /yr

25 $/hr x 2,080 hrs/yr = $52,000 /yr

30 $/hr x 2,080 hrs/yr = $62,400 /yr